Today I am going to give you a lesson in how a bank will manipulate your note. Attached to this blog today is the trail of the “Note”.

Before I begin I want to reiterate that, at our closing in April of 2004, before we arrived, the notary made a copy of our unsigned mortgage documents, creating two (2) packets. One packet was signed and handed to the notary, the other packet was signed and laid to the left of us until we completed the process. At the end of the closing, the notary took her stack and I presume, sent it back to the lender; and we took the packet to the left home with us, where it stayed until January 10, 2006 when I copied our documents into our former attorney’s file.

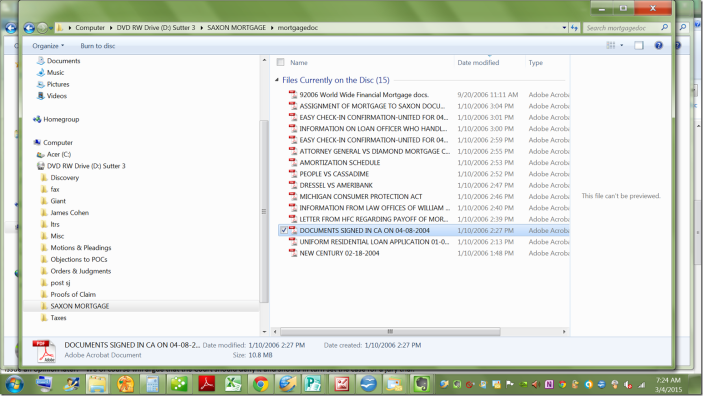

This is proof of the date and time that I scanned these documents into our former attorney’s file. The highlighted document is the mortgage documents that we left the closing with.

The reality of the situation is that no one person will ever sign their signature exactly the same way twice, EVER; let alone two people at the same time, on the same document. It’s never going to happen.

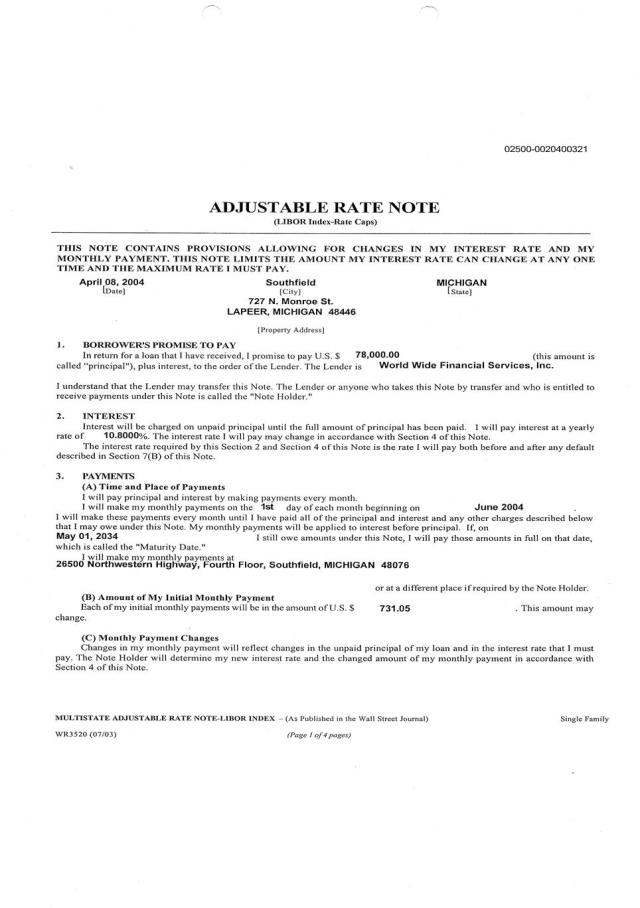

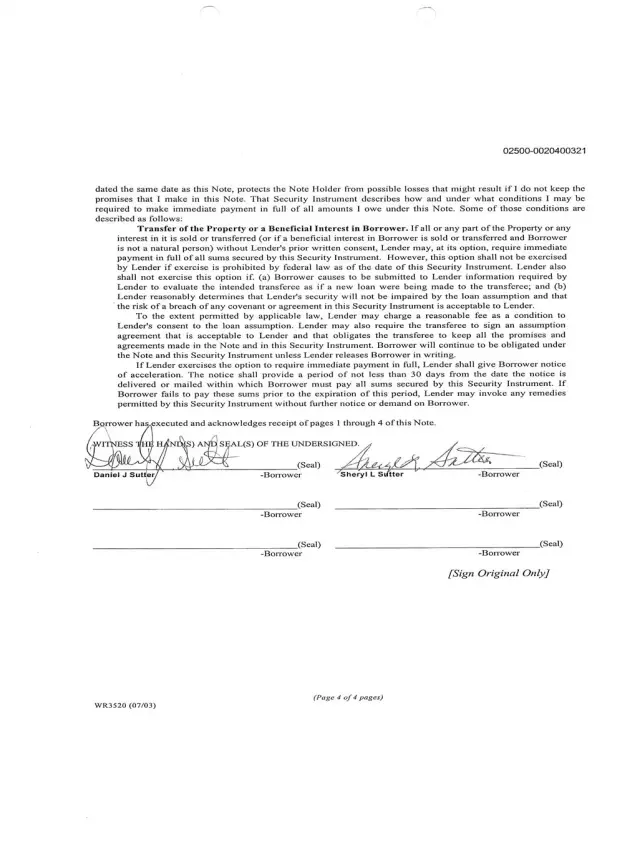

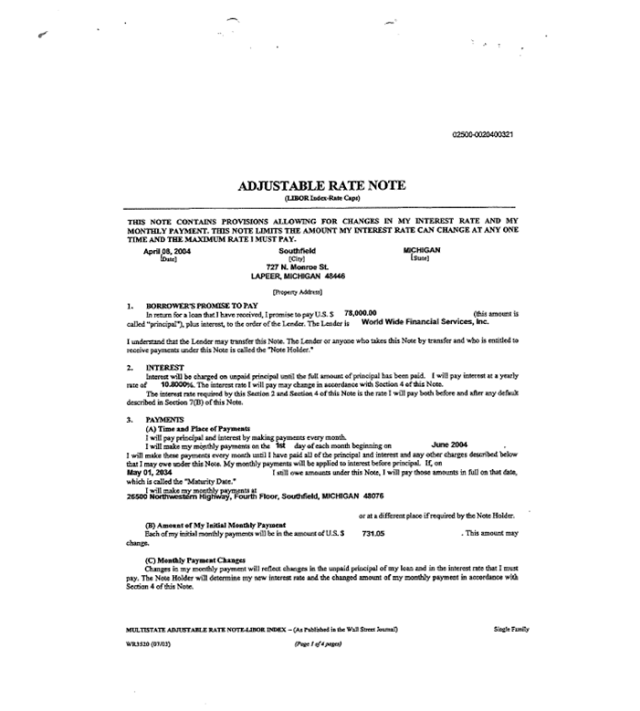

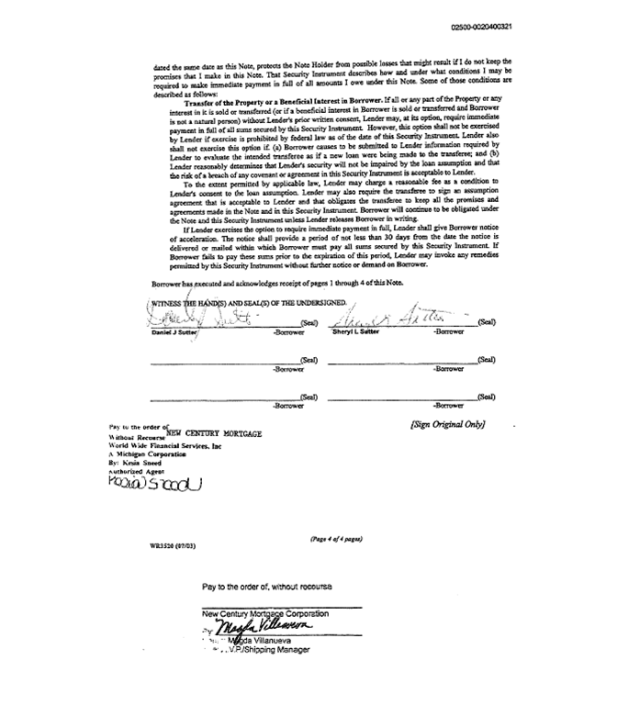

This proves that this bank, in October of 2005, when they initiated their wrongful foreclosure against us, did not own our property and never did. First of all, the trust that this “note” was supposed to be in, closed in July 2004. This bank offered a “Bailee Letter” that stated that this very “Note” was placed into the trust in July of 2004. Exactly how did they do that when this particular , wet-ink note is, has, and has always been, in my possession (refer to (1))? How is this an original when I hold this particular original “wet-ink” of this exact same document?

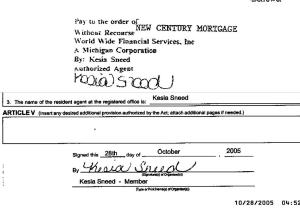

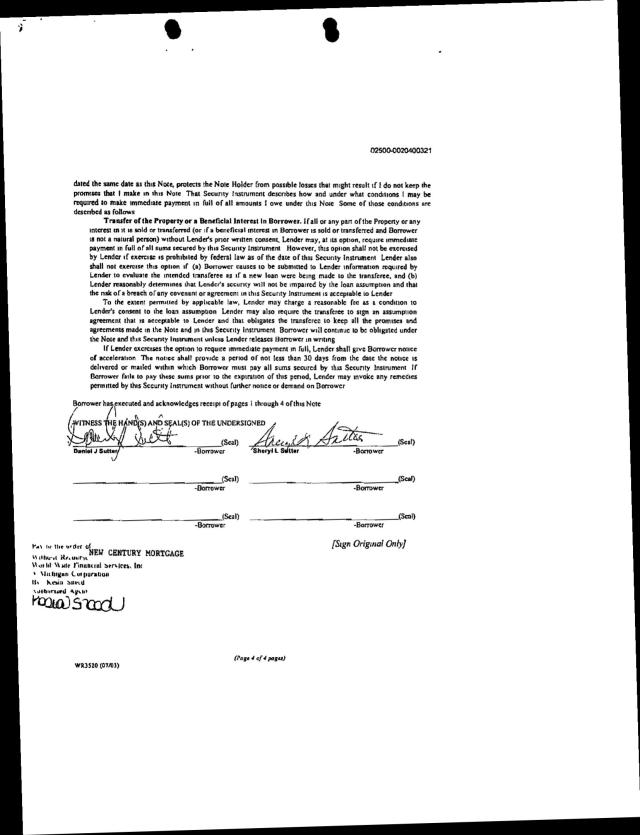

The bank’s first version of the note (refer to (2)) that was submitted to our attorney on September 20, 2006 (8 months and 10 days after I scanned this particular document) with a “note” stamp on the first page and the “endorsement” of Kesia Sneed on the signature page.

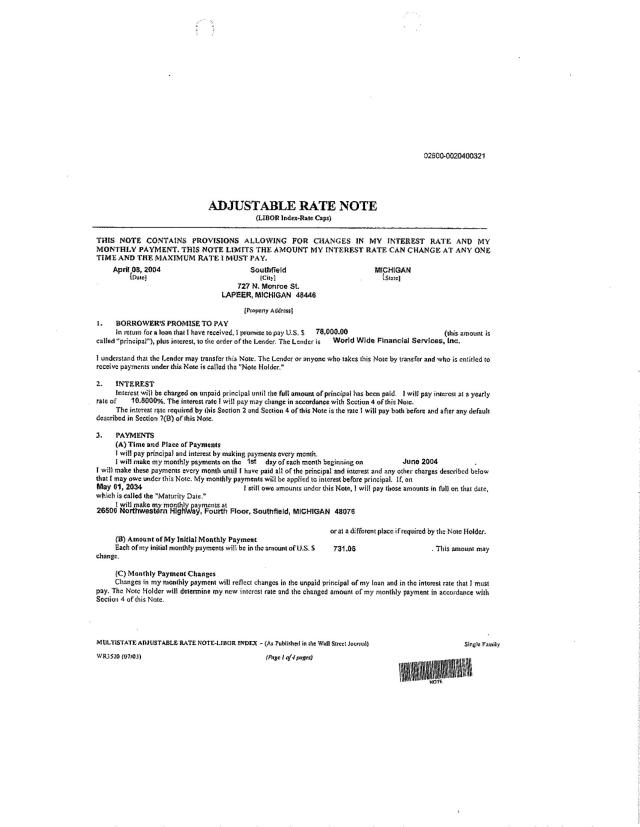

This would be the version that the bank would use throughout our bankruptcy adversary proceeding; two tours of the US District Court and our final deployment to the US 6th Circuit Court in an attempt to get these courts to give them an equitable mortgage based on fraud (refer to (3)).

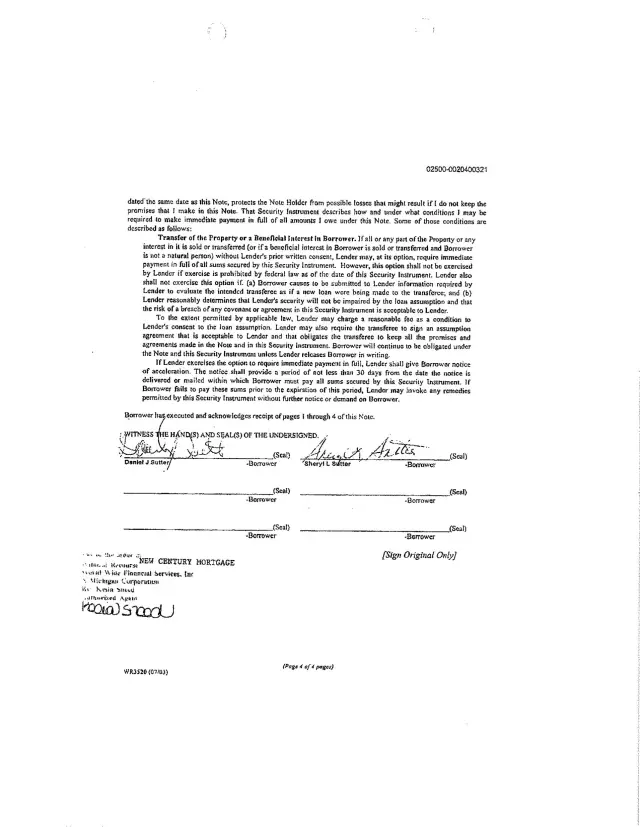

Move forward to 2013 (refer to (4)). The fourth note that would be used to start the 2013 lawsuit against us would be an exact copy of our original “wet-ink” duplicate; no endorsements or “note stamp”. This would be accepted by the court as cause for the case to move forward.

The fifth and final note to surface (refer to (5)) would be shown to be the original to our current attorney in April 2014; with no “note stamp” on the first page, the forged endorsement of Ms. Sneed and an undated stamped endorsement that showed a transfer from New Century to US Bank; not to mention our signatures appeared in “blue ink”. How is that when I have a complete packet that proves that we signed each and every document in “black ink” and exactly where was this document for the past ten years?

Let’s examine Ms. Sneed’s signature. The top evidence is the forged endorsement on the bank’s version of a note that we hold. The bottom evidence is the actual signature of the woman whose name was forged. This document is an official state document that verified the forgery. We hold a signed affidavit from this woman testifying to the fact that this is not her signature. In the real world, or at least I was raised to believe, this should be a serious problem. In our world it means nothing, because a poor strategy in a shill game let all this evidence mean nothing. It is allowing for the undoing of a decade of work and for the fraud to go away.

Outright Forgery of First Endorsement from Worldwide Financial to New Century Mortgage

However, it is not my mission to dwell on the outrageous; it is my mission to spread the word and wake people up, including our judicial system. It is my mission to take all these lessons and give a lesson to the world; while enlightening them to be wary of anything that entices them through the words and proclamations of “entities of public trust” and stand on the false claims of “integrity”.

This lesson is only on the Note. Over the next days, weeks, months; I’m going to take you on a fascinating journey as I guide you through a mortgage fraud case where the bank turned a package full of the homeowners documents into their own. By the time I am done you will understand what lengths were gone to in order to steal our home.

I hope you will join me and share, share, share; so that all can be enlightened as to how the banks and their legal representatives go about winning their cases, crushing your lives and stealing your property.

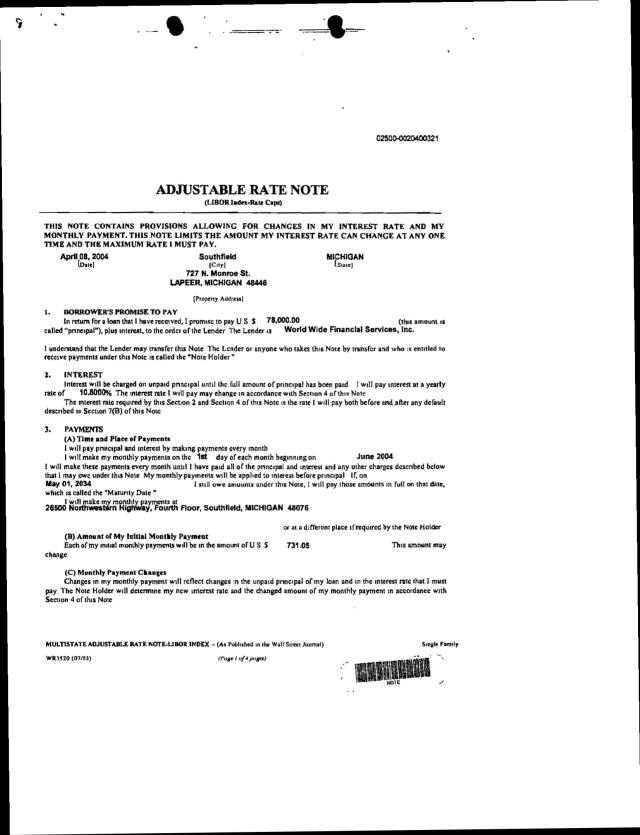

- (1) Our Original “Wet-Black Ink” Document that is still in our attorney’s possession.Page 1

- (1) Our Original “Wet-Black Ink” Document that is still in our attorney’s possession. Page 4

- (2) Bank’s First Version of their “Note” sent to our former attorney on September 20, 2006 – Page 1

- (2) Bank’s First Version of their “Note” sent to our former attorney on September 20, 2006 – Page 4

- (3) Bank’s Exhibit Version of the “Note” presented to three federal courts between 2008-2012 – Page 1

- (3) Bank’s Exhibit Version of the “Note” presented to three federal courts between 2008-2012 – Page 4

- (4) The Beginning 2013 Lawsuit Note

- (4) The Beginning 2013 Lawsuit Note

- (5) Bank’s Final Version of the “Note” – Page 1

- (5) Bank’s Final Version of the “Note” – Page 4

Hi— Great article, can you sue them for triple damages? Thanx—Kevin

I can not sue the bank for anything. Because of our attorney’s bad strategy we get to pay this bank $42,500. Hence the need for the goFundme page to fix our home that has all but fallen down around us during the past ten years. However, if there were such a thing as a Masters Degree in mortgage fraud, I can truly say that I have earned one. So I am taking all this evidence to the public; seeing that these frauds, despite the outcome of our case, still occurred and I have the evidence in black and white. I will use my skills to ensure that this never happens again to another homeowner.

My story is on http://www.phhmortgagemustbedestroyed.weebly.com I’m representing Loretta Lynch, our current USAG, who is the only enforcement agent authorized to enforce mortgage fraud under the 1987 Financial Institution Reform Regulation and Enforcement Act. This act has never been enforced in America. Occasionally some organizations have been intimidated and offered billions in consent judgments, and actions have been dropped. I am bringing my case to a jury trial, as is the right of any citizen in cases exceeding $20 in value. We’ve worked our way through Federal District Court and are currently before 5th USCA in New Orleans #14-51224. Any citizen can follow my template. 🙂

Unfortunately we got tanked by a back door case evaluation and our attorney’s poor strategic plan; I’m not sure this will work for me.

You have to look at your individual case and choose a strategy with the highest probability of success. For freezing the fraudulent action, I chose bankruptcy as the highest probability of stopping the action. I had all positive expectations, and no negative risks. For recovering my expense, I chose jury trial. It looks like 99% of attorneys have a conflict of interest when attacking banks. It looks like 99% of judges are corrupt. No jury has yet considered the mortgage fraud racket. This path has a low probability of success, but a huge potential reward, and the possibility of putting a criminal enterprise out of business. I’ve been fortunate to encounter some honest judges (yes, Virginia, there are a few left). I don’t expect my counterparties to be in business by 2020. They will go the way of Countrywide and WAMU. 2.9% of mortgage holders in America may have a better choice available. If I can contribute in some way to that, I feel great!