Mortgage assignments are documents that many of us never think twice about, because, as I will demonstrate, these are not documents that we sign and they are rarely in our possession unless we travel down to the local land records office and get a recorded copy. I stared at these assignments for what seemed ages, before it finally occurred to me what I was seeing. I knew that something wasn’t right, however, I was having a very difficult time putting my finger on it. Then, like a light bulb, it all became clear as to what exactly had occurred with the various assignments that would be involved with our case, yet never brought to light because we were too busy fighting the shiny object; a forged mortgage.

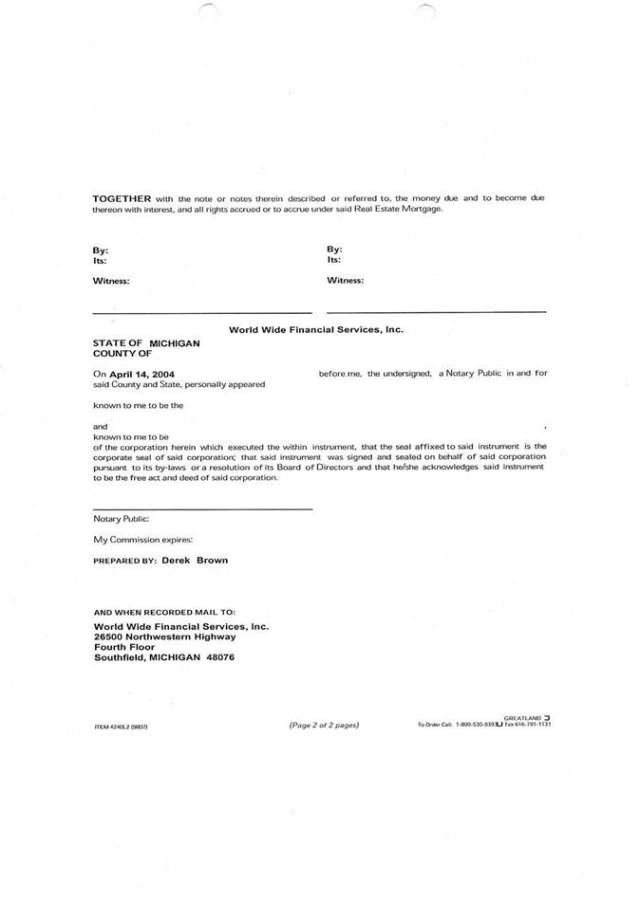

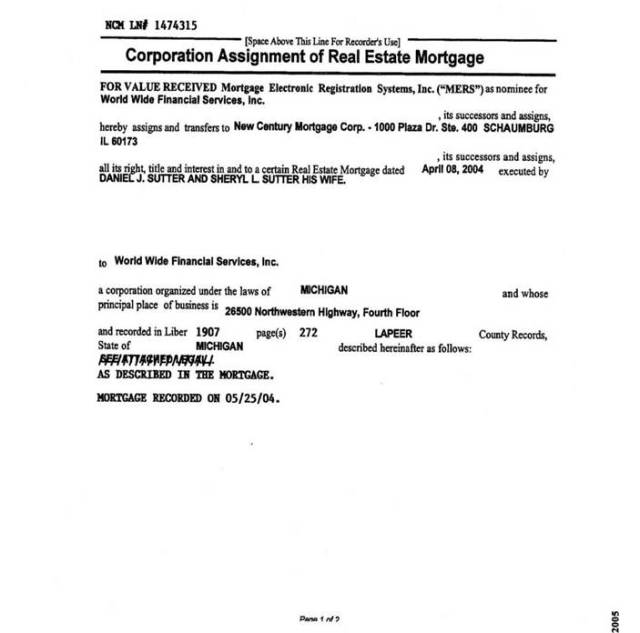

Our documents contained two (2) Corporate Assignments of Real Estate Mortgage documents. The first one was a non-MERS assignment:

Corporate Assignment of Real Estate (Non-Mers) Page 1 from our documents

Corporate Assignment of Real Estate (Non-Mers) Page 2

The first thing that I would notice about this document was that there was already a post-dated notary date on this document.

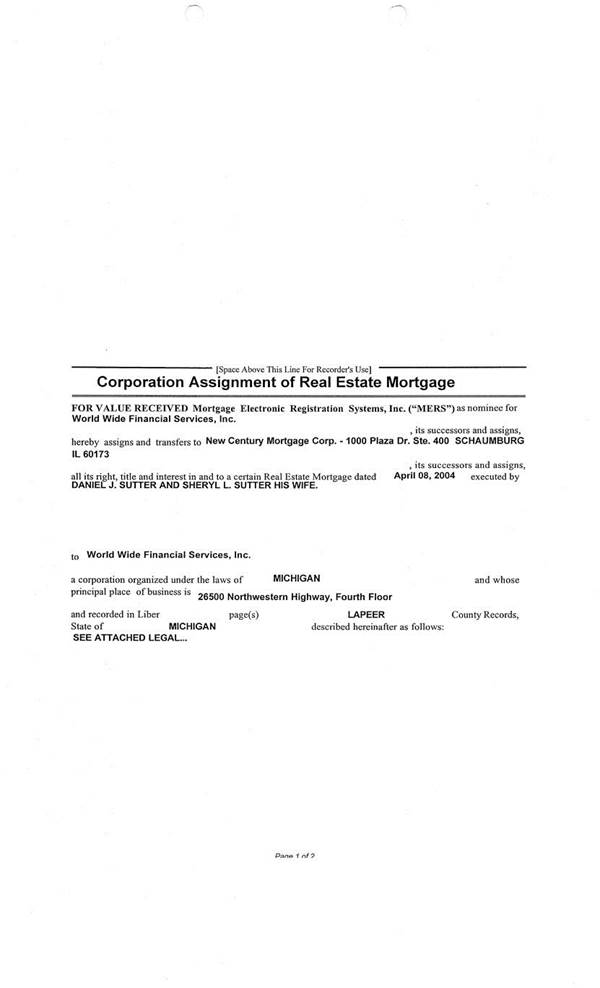

The second assignment documents in our packet was a MERS Corporate Assignment:

MERS Corporate Assignment of Real Estate from our packet (Page 2)

MERS Corporate Assignment of Real Estate from our packet (Page 2)

By the time that these two documents had made their rounds, the final resulting document would be a combination of page 1 of the MERS Assignment and page 2 of the non-MERS assignment; as well as two versions of the same document. Allow me to demonstrate:

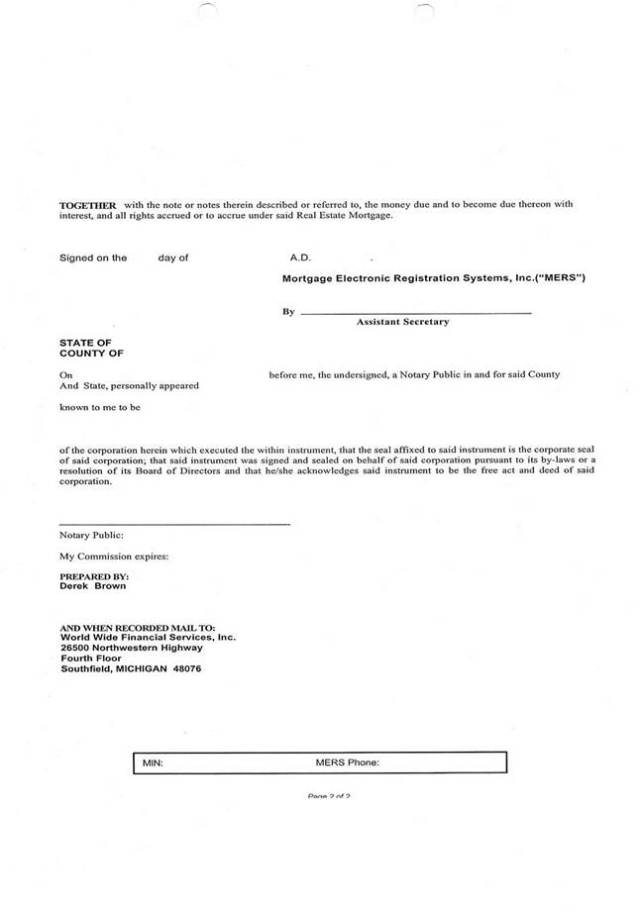

This is the Corporate Assignment that was sent to our former attorney on September 20, 2006:

Assignment sent to our former attorney on 09-20-2006 (Page 1)

On this page I want you to note the “CORP” stamp located on the lower right hand side of this document. Now let’s look at their discovery submission of page 2:

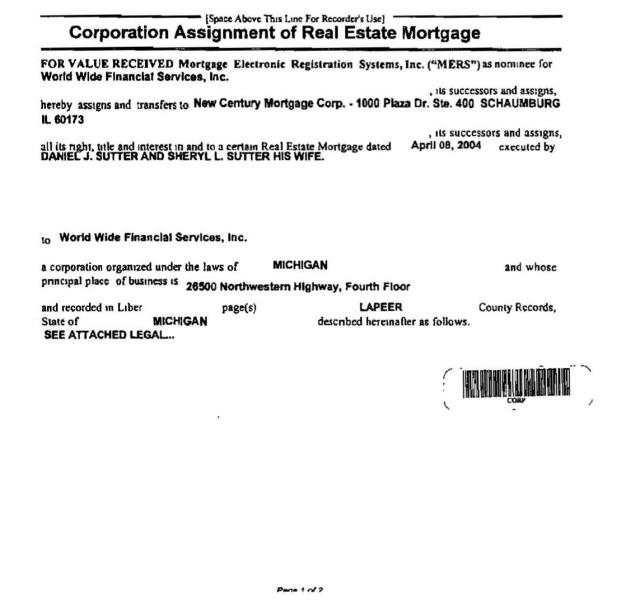

Assignment sent to our former attorney on 09-20-2006 (Page 2)

On this document I want you to notice that notarization date; didn’t we see that before? Oh, that’s right, it was there at the closing which happened on April 8, 2004. Also, make note of the “When Recorded Mail To:” information as well; because now I am going to show you what is behind door number three!

This version of the Corporate Assignment was recorded one year and one month after the forged mortgage in our case was recorded, and it is after US Bank allegedly owned the “note”. One must wonder why this document would not have been recorded when the original mortgage was recorded; after all it all pertained to the same “transfer” and had nothing to do with US Bank.

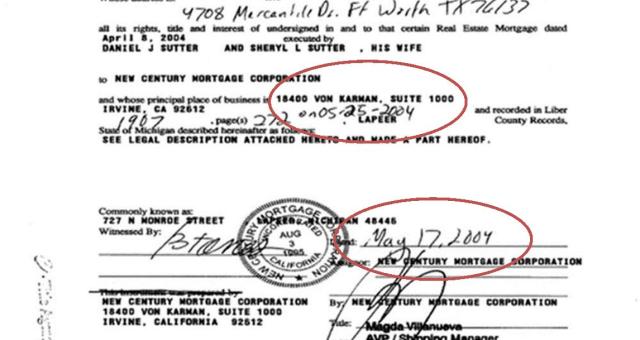

Ah, and another thing you will discover with this last version of the “Corporate Assignment of Real Estates”; part MERS, part not, has some additions since the last time we saw this notarized copy. You will discover that this notary was so smart that she even knew the date, liber and page of a recording in the future; over a month in the future…wish I had that skill!

This is the recorded copy of the original assignment to New Century Mortgage (not US Bank) Page 1

This is the recorded copy of the original assignment to New Century Mortgage (not US Bank) Page 2

From the document that was submitted to our former attorney for discovery, to this recorded document, there are many manipulations to behold. Let us make a list, shall we?

- A loan number has mysteriously appeared in the upper right hand corner

- A date, liber and page number have been added to this already notarized document that references a date in the future

- Remember the “CORP” stamp on the discovery version…Where did it go?

- On the second page we now see that the document is to go to California as opposed to Southfield, Michigan.

Last time I checked, it was illegal to alter a document after notarization; however, in this case we can’t trust that notary date either.

What you need to realize is that this is only the first assignment from the original lender to the second lender, New Century Mortgage. Now let’s tackle that sweet little assignment from New Century Mortgage to US Bank.

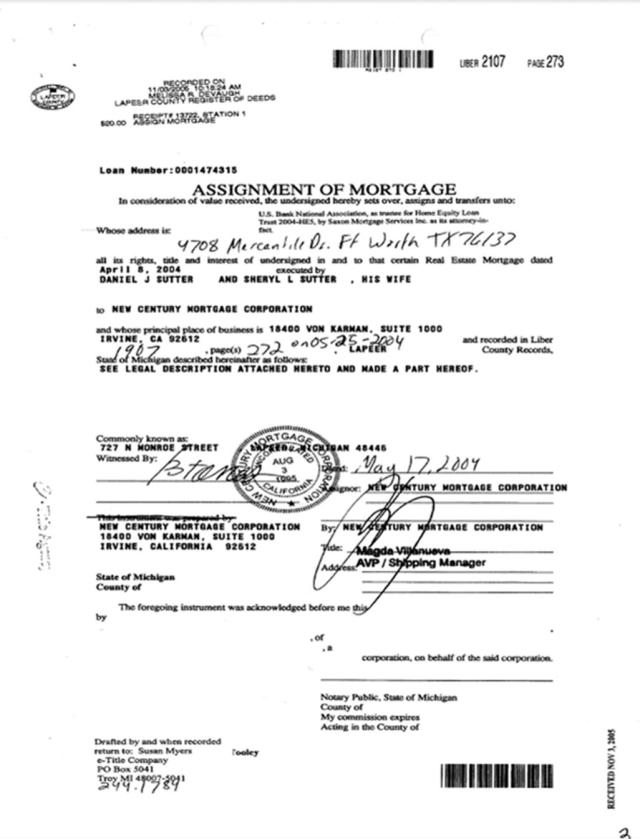

This is the recorded assignment where New Century Mortgage allegedly transferred the mortgage to US Bank

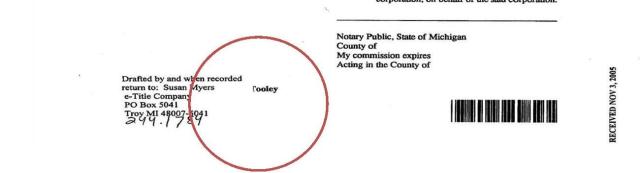

Now this document is very special. First of all, ETitle Agency is owned by the very law firm that started the illegal foreclosure proceedings against us. At the time that this assignment allegedly happened Orlan’s Associates were not a part of any of this, yet here is their title agency, not only involved in the assignment of the mortgage from New Century Mortgage to US Bank, but involved with document manipulation as well.

First of all, if you are going to get into the business of technical fraud you should at least be good at it as the following image will demonstrate:

It clearly shows that there was other information under this copy and paste. Another interesting fact about this is the recorded date of November 3, 2005. If this was transferred to you in May of 2004, why would you wait until after you started foreclosure proceedings to record it?

The next image also demonstrates again, the amazing precognitive skills of these notaries. Yet another notary with amazing skills to be able to know information that will happen in the future…I surely want this skill!

My last is a general observation of the document as well. If a document has a place where it is supposed to be notarized; why are our land records so full of inaccurate and improperly certified documents that involve the land of it’s citizens?

My last is a general observation of the document as well. If a document has a place where it is supposed to be notarized; why are our land records so full of inaccurate and improperly certified documents that involve the land of it’s citizens?

Well, that concludes today’s lesson on spotting fraud in assignments. I’m not sure what my next lesson will be, however, I am sure that it will be just as thrilling and informative as this one.

Again, share, share, share; because if you think that any of this is acceptable, you are reading the wrong blog.

Reblogged this on The Right Advocate.

This is where the world of collateralized debt obligations meets the world of property. Collateralized debt obligations are by their nature fraudulent transactions. The corporation who financed your property transferred all his rights to receive payments to XXXX for an undisclosed sum of money. He eliminated the risk that you, on 123 Anywhere Street in Somewhere, Arkansas would stop sending those payments. He grouped your property into a collateralized debt obligation of [manyproperties] in [manyplaces] with [manyproprietors]. Or if you did stop making payments, for some unknown reason, the cashflow would not be interrupted because the 999 other pieces of the collateralized debt obligation would continue to trickle in. Or if a proprietor decides to make prepayments, the entire cashflow will be diminished. He went a step further and insured the whole cashflow, just in case an earthquake in California dropped it off the map, and 328 properties disappeared. The individual property would remain a problem of the proprietor. The cash flow to the investor would continue, EVEN AFTER THE COLLATERAL HAD DROPPED INTO THE OCEAN. He collateralized the entire statistical cash flow. Since property can’t be collateralized more than once, he released his collateral rights of the individual properties in the collateralized debt obligation. This fact is clearly stated in the documentation forming the issuance of the security, where all individual collateral rights to the component assets are excluded. Like fine sausage, it tastes good, but cannot be examined speck by speck. Under examination, it would be revolting. Also illegal.

If I’m an investor, I also have the option of paying a little more, and just taking the tranche of interest only, properties up to three years old maximum, where the actual interest yield can be 235% or more, with no risk. I’ll pay a premium for such investment. Or if I’m feeling bearish, I can get a good deal on the tranche of principal only, properties only 20-30 years old, very secure on principal but not yielding much interest. The investors can trade these tranches among themselves, without risk, and not having to wait for inconvenient maturity periods of thirty years away. They don’t have the risk of the proprietor changing jobs or getting sick, they don’t have the risk of summer wildfires in Arkansas, and they don’t have to talk to those crazy, irate people on the phone who are always wanting something. The mortgage servicer does all that, for a fee. They go to great lengths to shield the proprietors from the knowledge that they have surrendered all their collateral rights at Step One. They have no standing in any court to enforce collateral rights. They will lie, cheat, and steal to intimidate a proprietor to send in money. They will hire as many lawyers as necessary to enforce the scam. They will bribe judges. They will change venues. They will ask for extensions. They will give money to congresspersons. They will get bailouts to make ends meet. They will go bankrupt, blink out of existence for a bit, and resurface in a CDO-Squared somewhere else. Like cockroaches, they will work in the dark and devour everything in the kitchen. When the lights come on, they will disappear. They need to be exterminated.

I contend that these collateralized debt obligations cannot be enforced. Many people are joining in. Warren Buffett calls these toxic instruments of destruction. We are strange bedfellows in this matter. Now Bernie and Elizabeth want to climb into bed. It’s a developing situation. My claims are built on rock ‘Thou shalt not steal.’ My counterparties’ claims are built on shifting sands, fraudulent claims, forged documents, expediency, bribes…they need to be untangled and exposed one by one. It’s time consuming. It’s honest work.

I have been effected by mortgage fraud on many aspects .

first the mortgage note in ohio does not allow 10 late fees under penalty of forfeiting all the interest paid to the lender under oRC1321.57.

judge David Ellwood in Guernsey County court of Common pleas never even considered that. neither did the Appeals Court 5th district. as a third party paid off my loan before foreclosure and I sent notices that I retained the right to procede without a settlement as Ii was not involved in the settlement.

As evidence of compliance an affidavit was sent from Ocwen loan servicing by Christina Carter stating that she was aware of the account and all payment were applied properly.

She lied as payments for illegal late fees were added and not applied and payments tendered were refused to the amount of over $20,000.

I called her on that stating to her directly that either she lied when she filed the affidavit that she knew all of the facts or that she knew that the charges and refused payments were illegaland that she was part of the fraud. I told her either way she should be going to jail soon.

she is no longer with Ocwen loan servicing…no reason given,

the person Leticia Arles who notarized the affidavit was also implicated as the notary for a well known MA case of forged signatures . you will see she notarized 4 different initial for the same person at the Ocwen offices. . and Christina Carter had several variations of signatures.

I called the notary bonding service and informed them of the pending cases and the variations that she has signed for and she is no longer a notary nor bonded.

my case also cites the Ohio law on insurance fraud . During my time paying insurance the coverage raised for 98,000 to over 158,000, but the market was declining and the property value were reduced . I cancelled my insurance because the insurance company would not reduce the stated coverage. to the mortgage note level and the appraised value of about 68,000.

the mortgage service provider place forcible 158,000 of insurance on the 68,000 dollar home . I claimed it was insurance fraud as it attempted to overvalue an asset in which insurance was placed upon it . it fits the description . I wrote and called to get it reduced for years no action was taken.

I eventually reinsured the house myself at 68,000 but was not reimbursed for the overages.

the ownership documentation was all “lost” but that i believe is fraud too as they never had ownership papers.

William Erby was the president and I sent him notice. the company Ocwen claimed ownership… note I say claimed .. the original mortgage company was AMRESCO residential mortgage. they went bankrupt for making a bunch of bad and illegal loans. The loans should have all dissolved or been renegotiated in bankruptcy court but since Mr erby and Ocvwen were servicing the loans they just kept collecting the payments … then they claimed that they owned the loans without any ownership papers . Mr Erby is now a billionaire living in the US Virgin Islands in the carribean managing a “fund” . collecting on home loans he never owned.

in short I was cheated out of $20,000 in legal fees I paid . $73,000 in interest that should have been forfeit under Ohio law , $78,000 in fraudulent insurance

thousands in trumped up court costs like skip tracing fee and personal service fee when I lived in my own home and the mortgage note says all notification will be by mail. and of course $20,000 or more in payments I made with cashiers checks and money orders that were refused in violation of Ohio laws of tender.

this is my affidavit d Dianne Baginski

I hope you know that Ocwen was the first company to enter a consent judgment in Dec. 2013, admitting to all your claims, and promising to cease and desist, and not go to jail. They have an oversight trustee managing restitution, Joseph A Smith. Contact them and get your money. 🙂

We are involved in that one regarding their forced insurance. We had insurance yet they insisted we didn’t and would purchase it anyways. I am fed up and I have always been of the mind set that there is more than one way to skin a cat. This is too much evidence and the fact that I can prove they never had those documents before January 10, 2006 at 2:27 pm and have an affidavit of the woman whose signature they forged means there is no libel or slander on my part. So today I tell you; tomorrow I tell the county; and the next day I tell the world. Sooner or later someone in a position to help will find this as malicious and outrageous as I do and they will help us tank these low life attorney’s that turn the halls of justice into a mockery.